The Quarterly Business Review (QBR) is a cornerstone of customer success, yet many Customer Success Managers (CSMs) struggle to elevate it beyond a simple data dump. A truly effective QBR is not just a backward-looking report; it is a forward-looking strategic session that strengthens partnerships, uncovers opportunities, and solidifies value. The challenge lies in structuring these reviews to be both comprehensive and compelling.

Moving past generic slides requires a deep understanding of what resonates with stakeholders. In this guide, we will dissect powerful quarterly business review examples, providing a blueprint for CSMs to craft QBRs that command attention and drive results. We will explore diverse formats, from executive dashboards to customer-centric deep dives, and provide actionable analysis on structure, key metrics, and presentation strategies.

This breakdown will help you transform your next client meeting from a routine check-in into a high-impact strategic asset. You will learn not only what to include but how to present it for maximum effect, ensuring you demonstrate clear ROI and align on future goals. By mastering these examples, you can build a replicable process for delivering value quarter after quarter.

The Executive Summary Dashboard is a powerful format for a quarterly business review, prioritizing speed and clarity for a high-level audience. It condenses the most critical performance data into a single, visually scannable page, making it ideal for presenting to senior leadership, board members, or any stakeholder with limited time.

This approach leverages charts, graphs, and prominent key performance indicators (KPIs) to tell the quarter's story at a glance. Think of it as the highlight reel of your business performance. Companies like Microsoft and Adobe frequently use dashboard-style summaries in their quarterly earnings reports to quickly communicate progress on core metrics like revenue, user growth, and subscription renewals. This format is one of the most effective quarterly business review examples because it forces you to focus only on what truly matters.

The strength of the dashboard lies in its ability to communicate complex information efficiently. By presenting data visually, it bypasses the need for dense paragraphs, allowing executives to immediately grasp trends, wins, and potential red flags. The structure is designed for quick decision-making, providing a top-down view of the business's health.

For example, a bar chart can instantly show whether you hit your revenue target, while a trend line can illustrate customer engagement over the past 90 days. This visual immediacy is far more impactful than a simple number buried in a report.

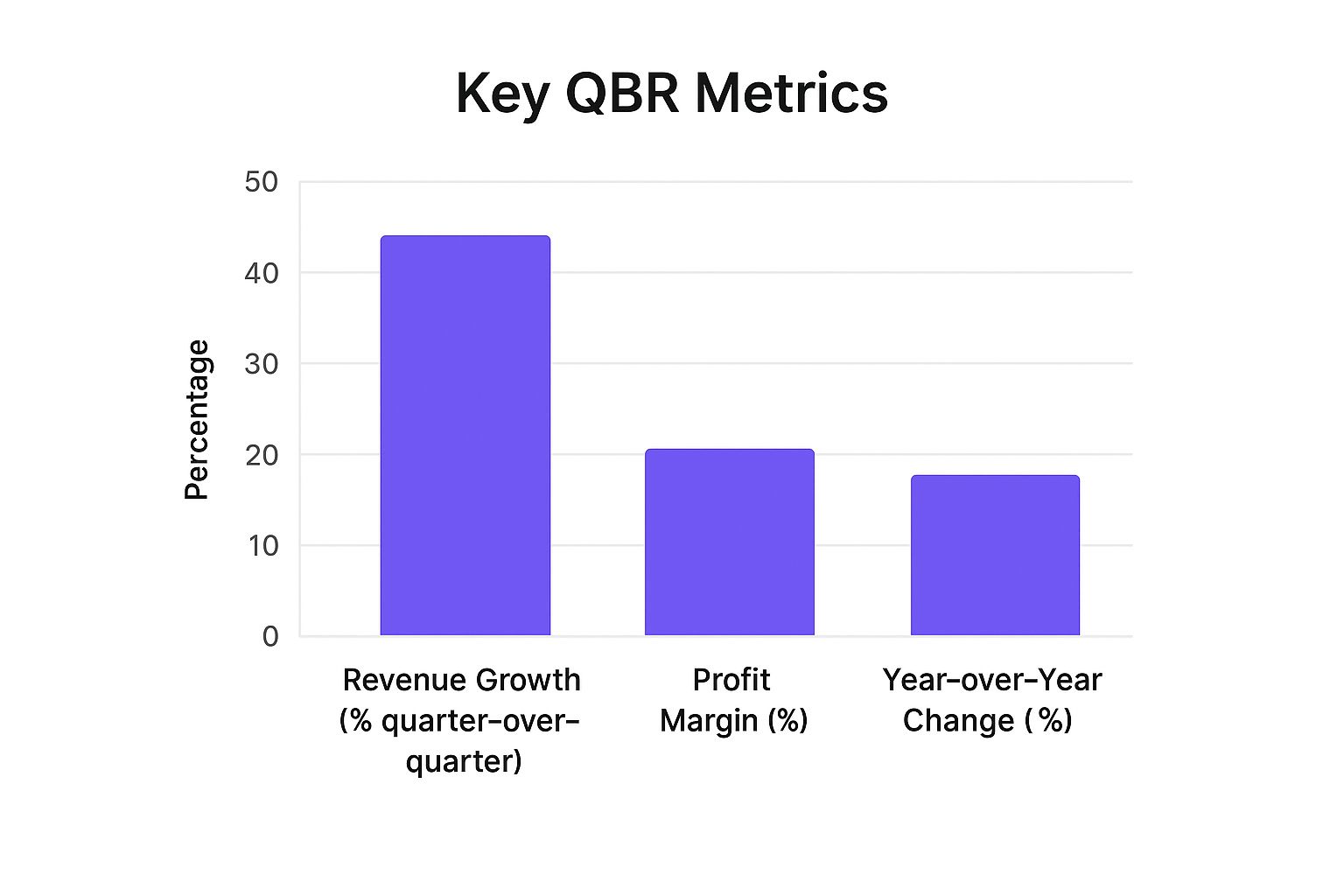

The following chart visualizes three essential metrics often featured in an executive dashboard to provide a quick snapshot of company health.

This visual representation makes it easy to see positive quarter-over-quarter revenue growth alongside a healthy profit margin and significant year-over-year improvement.

To implement this format effectively, follow these tactical steps:

The Functional Department Deep-Dive is a classic quarterly business review format that systematically assesses the performance of each core business unit. This comprehensive approach breaks the review into distinct sections for Sales, Marketing, Operations, Finance, and HR, ensuring every department’s contribution is scrutinized against its goals. It provides a granular, bottom-up view of organizational health.

This method is rooted in the management philosophies of traditional Fortune 500 companies like General Electric and Procter & Gamble. They use this structure to manage vast, complex operations by holding each functional leader accountable for their specific domain. This format is one of the most enduring quarterly business review examples because it promotes accountability and alignment across the entire organization.

The power of this format lies in its structured detail and comprehensive scope. By dedicating time to each department, leadership gains a full-spectrum understanding of business drivers, obstacles, and interdependencies. It prevents critical functions from being overlooked and ensures that departmental strategies are in sync with overarching company objectives.

For instance, the marketing deep-dive might reveal a high volume of leads, but the sales section could show a low conversion rate for those same leads. This direct comparison immediately highlights a misalignment in lead quality or sales enablement, prompting a cross-functional discussion that a high-level summary might miss. This structured approach fosters transparency and collaborative problem-solving.

To implement this format effectively, follow these tactical steps:

The OKR-Based Performance format centers the quarterly business review entirely around Objectives and Key Results. This approach provides a powerful framework for evaluating performance against specific, ambitious goals set at the beginning of the quarter. It moves the conversation beyond just past performance and focuses on forward-looking goal attainment, learning, and continuous improvement.

This format is renowned for its use by tech giants like Google and LinkedIn, which structure their quarterly assessments around the OKR framework. By tying every discussion point back to a predefined Objective and its measurable Key Results, teams can maintain intense focus and alignment. This makes it one of the most effective quarterly business review examples for organizations that prioritize transparent, goal-oriented growth and accountability.

This visual breaks down the process, showing how a high-level Objective (like improving customer onboarding) is supported by specific, quantifiable Key Results.

The strategic advantage of an OKR-based QBR is its inherent focus on outcomes over outputs. Instead of just listing activities completed, this format forces a critical assessment of whether those activities actually moved the needle on key business results. It directly connects daily work to the company's broader strategic priorities.

For instance, a team might have launched a new feature (an output), but the OKR review would measure its success based on the Key Result, such as a "15% increase in user engagement with the new feature." This structure fosters a culture of accountability and ensures that resources are allocated to initiatives with a measurable impact. It also promotes psychological safety by treating missed targets not as failures but as valuable learning opportunities to inform the next quarter's strategy.

To execute an OKR-based QBR successfully, integrate these tactical steps:

The Financial Performance Focus format anchors the quarterly business review entirely on financial health, making it a critical tool for publicly traded companies, investment-focused firms, or any business undergoing significant growth or recovery. This approach prioritizes metrics like revenue, profitability, cash flow, and budget variance, presenting a rigorous, data-driven narrative of the quarter.

This format is common in settings where financial accountability is paramount. For instance, Warren Buffett's reviews for Berkshire Hathaway and JPMorgan Chase's quarterly earnings calls are prime examples of this financially-centric model. They dissect financial statements to provide stakeholders with a transparent view of the company's fiscal stability and performance, making it one of the most respected quarterly business review examples for finance-heavy industries.

The power of this format is its uncompromising focus on the bottom line. It directly answers the most pressing questions from investors, board members, and senior executives: "Did we make money?" and "How financially sound are we?" By centering the conversation on hard numbers, it removes ambiguity and provides a clear, objective measure of success or failure.

This structure forces a deep dive into financial drivers. Instead of just reporting revenue, it scrutinizes profit margins, operating expenses, and cash flow statements to uncover the story behind the numbers. When focusing on financial performance within a QBR, identifying areas for financial improvement is key. For actionable insights, consider exploring strategies to improve cash flow to strengthen your company's fiscal position. This level of detail builds credibility and demonstrates rigorous financial management.

To execute a financial performance-focused QBR effectively, use these tactical steps:

The Customer-Centric Performance Format places the customer at the heart of the quarterly business review. This approach is essential for subscription-based businesses, SaaS companies, and any organization where long-term customer relationships are the primary driver of revenue and growth. It shifts the focus from purely financial metrics to indicators of customer health, loyalty, and value.

This format prioritizes metrics like customer acquisition cost (CAC), lifetime value (LTV), churn rate, and net promoter score (NPS). Companies like HubSpot and Salesforce are pioneers of this model, structuring their quarterly assessments around customer success and expansion. By doing so, they create a direct line of sight between customer satisfaction and business performance, making it one of the most insightful quarterly business review examples for modern, recurring-revenue businesses.

The strategic power of a customer-centric QBR is its proactive nature. Instead of just reporting on past revenue, it provides leading indicators of future financial health. A declining customer health score or a rise in support tickets can signal potential churn long before it impacts the bottom line, allowing teams to intervene preemptively.

This format encourages a deeper understanding of the customer journey. For instance, analyzing user engagement data can reveal which product features drive retention, while qualitative feedback from surveys can uncover pain points that need immediate attention. Crucially, for the Customer-Centric Performance Format, your QBR should rely on effective strategies for measuring customer satisfaction that genuinely drive growth. This transforms the QBR from a simple report into a strategic tool for enhancing product value and customer loyalty.

To successfully implement a customer-centric QBR, focus on these tactical steps:

The Strategic Initiative Progress format shifts the focus of a quarterly business review from routine operational metrics to the advancement of major, long-term strategic projects. This approach is ideal for organizations undergoing significant change, such as a digital transformation, market expansion, or a major product pivot. It aligns the entire discussion around the handful of large-scale initiatives that will define the company's future.

This format moves beyond simple KPIs to track milestones, resource allocation, and risk mitigation for critical projects. Companies like General Motors use this model in their quarterly assessments to detail progress on their electric vehicle transition, focusing on factory retooling, battery production, and new model launches. Similarly, Disney’s quarterly reviews during the launch of its streaming services centered on subscriber growth, content pipeline development, and international expansion goals. This makes it one of the most forward-looking quarterly business review examples available.

The power of this format is its ability to create a direct link between day-to-day activities and the company's long-term vision. It ensures that leadership discussions are not bogged down by minor operational fluctuations but are instead centered on whether the most important strategic bets are on track to succeed. The structure forces accountability and cross-functional alignment on high-stakes projects.

By framing the QBR around specific initiatives, you can assess progress using both leading and lagging indicators. For example, a leading indicator for a digital transformation might be the percentage of employees trained on a new system, while a lagging indicator would be the resulting improvement in operational efficiency. This provides a more holistic view of progress than revenue alone.

To execute a Strategic Initiative Progress QBR effectively, use these tactical steps:

We’ve journeyed through a powerful collection of quarterly business review examples, each offering a unique lens through which to view and communicate customer value. From the high-level clarity of the Executive Summary Dashboard to the granular detail of a Functional Deep-Dive, these formats provide a robust toolkit for any Customer Success Manager. The key isn't to pick one and stick with it forever; it's to master the art of blending and adapting.

The most impactful QBRs are strategic hybrids. Imagine starting a high-stakes executive meeting with a crisp OKR-Based Performance slide, then transitioning seamlessly into a Strategic Initiative deep-dive to showcase progress on a critical project. For a more operational audience, you might begin with the Customer-Centric Performance format to celebrate shared wins before pivoting to a Financial Performance Focus to justify budget for the next phase. The power lies in your ability to curate the right story for the right audience.

Ultimately, the goal is to elevate the QBR from a simple reporting exercise into a cornerstone of your strategic partnership. The examples in this guide all share a common DNA built on three core principles:

Mastering these quarterly business review examples is more than a professional development exercise; it's a direct investment in customer retention and expansion. When you deliver a QBR that provides genuine insight and sparks strategic conversation, you build unshakable trust. You transform your role from a reactive problem-solver to a proactive, value-driving consultant.

This is how you secure renewals, uncover expansion opportunities, and build a reputation for excellence. By adopting and adapting these frameworks, you ensure your QBRs are not just meetings your clients have to attend, but sessions they truly look forward to.

Ready to eliminate the manual data wrangling and build stunning, insight-rich QBRs in a fraction of the time? Statisfy connects all your customer data into a single platform, automating the creation of the dynamic dashboards and reports you need to prove value. Transform your preparation process and focus on what truly matters: delivering strategic insights that strengthen customer relationships.