Let's stop thinking about customers in terms of one-time sales. Instead, what if we viewed them as long-term investments? This simple shift in perspective is the entire idea behind Customer Lifetime Value (CLTV). It’s a powerful metric that calculates the total profit you can expect from a single customer over the entire time they do business with you.

Think about it like this. Imagine you run a local coffee shop. A tourist might stop in, buy a $5 latte, and you'll never see them again. But a local who lives around the corner might buy that same $5 latte every day for the next ten years. That first transaction is worth $5. The second customer, however, represents thousands of dollars in lifetime value. CLTV is the tool that lets you see that crucial difference.

When you start tracking CLTV, your focus naturally moves away from chasing short-term sales targets. You start thinking about how to build genuine, lasting relationships with the people who are most loyal to your brand. This isn't just a marketing metric; it's a strategic shift that impacts everything from sales to product development.

CLTV isn't just a single, static number. It actually comes in two main flavors, each telling a different part of the customer's story. To get a full picture of your business's health, you really need to understand both.

Historical CLTV: This is the rearview mirror. It looks backward at what has already happened and simply adds up all the profit a customer has generated from their past purchases. It's straightforward and based on concrete data.

Predictive CLTV: This is the crystal ball. It uses historical data and statistical models to forecast how a customer is likely to behave in the future. This is where you estimate the total value they will bring over their entire relationship with your brand.

In the early days, businesses only had historical CLTV. If a customer spent $50 per purchase and made 20 visits, their historical CLTV was a clean $1,000. But today, predictive CLTV models can analyze everything from purchase frequency and churn risk to acquisition costs to paint a much richer, forward-looking picture. If you want to dive deeper, you can explore a breakdown of these CLTV models and their applications.

At its core, CLTV answers a simple but vital business question: "Which customers are worth investing in?" It gives you a data-backed way to prioritize your most valuable relationships and make sure you're putting your time and money where they'll deliver the biggest long-term payoff.

This is the kind of thinking that separates great brands from the rest. They don't just acquire customers; they cultivate them. They understand that the real win isn't a single transaction but the loyalty and repeat business that creates sustainable growth and makes a business resilient, no matter how competitive the market gets.

It’s easy to get lost in a sea of business metrics, but if you could only pick one to guide your company, Customer Lifetime Value (CLTV) would be a serious contender. Think of it as your business’s compass. It doesn't just point to quick wins; it guides every strategic decision you make toward sustainable, long-term growth.

When CLTV becomes your "North Star," something interesting happens. The walls between departments start to come down. Marketing, sales, product, and support all begin rowing in the same direction: finding, keeping, and delighting customers who will stick around for the long haul. This is a game-changer, shifting the entire company from a transactional, "what's the next sale?" mindset to a relational one.

A laser focus on CLTV gives everyone in your organization a shared goal and a clear sense of purpose.

This unified approach fundamentally changes how you think about customer acquisition. It’s no longer about hitting a quota of new sign-ups. It becomes a mission to attract and nurture the kind of customers who will become the bedrock of your business for years to come.

By focusing on the long-term value of a relationship, you stop treating customers as mere data points in a sales report. Instead, they become valuable partners in your journey, and you become a trusted provider in theirs.

The strategic importance of CLTV is directly tied to profitability and financial smarts. We all know acquiring a new customer is expensive—anywhere from 5 to 25 times more expensive than keeping an existing one. That stark reality makes a powerful case for investing in the customer experience to maximize lifetime value.

This cost gap is precisely why retention efforts are so valuable. A dollar spent on improving loyalty and reducing churn almost always delivers a higher return than a dollar spent chasing a brand-new lead. It's essential to understand how these investments pay off, which is why calculating marketing automation ROI goes hand-in-hand with a solid CLTV analysis.

When you let CLTV guide your budget, you naturally start allocating your money to the activities that have the biggest impact on your bottom line over time. This doesn't just fatten your profit margins. It builds a more resilient, predictable business that can confidently navigate market ups and downs.

The formula for Customer Lifetime Value can look a little intimidating at first glance. But really, it’s just a story about your customers told with numbers. It's built on a few straightforward, powerful ideas that track how people actually shop with you. Let's pull back the curtain and break down the calculation into its core parts, making it accessible for any business owner.

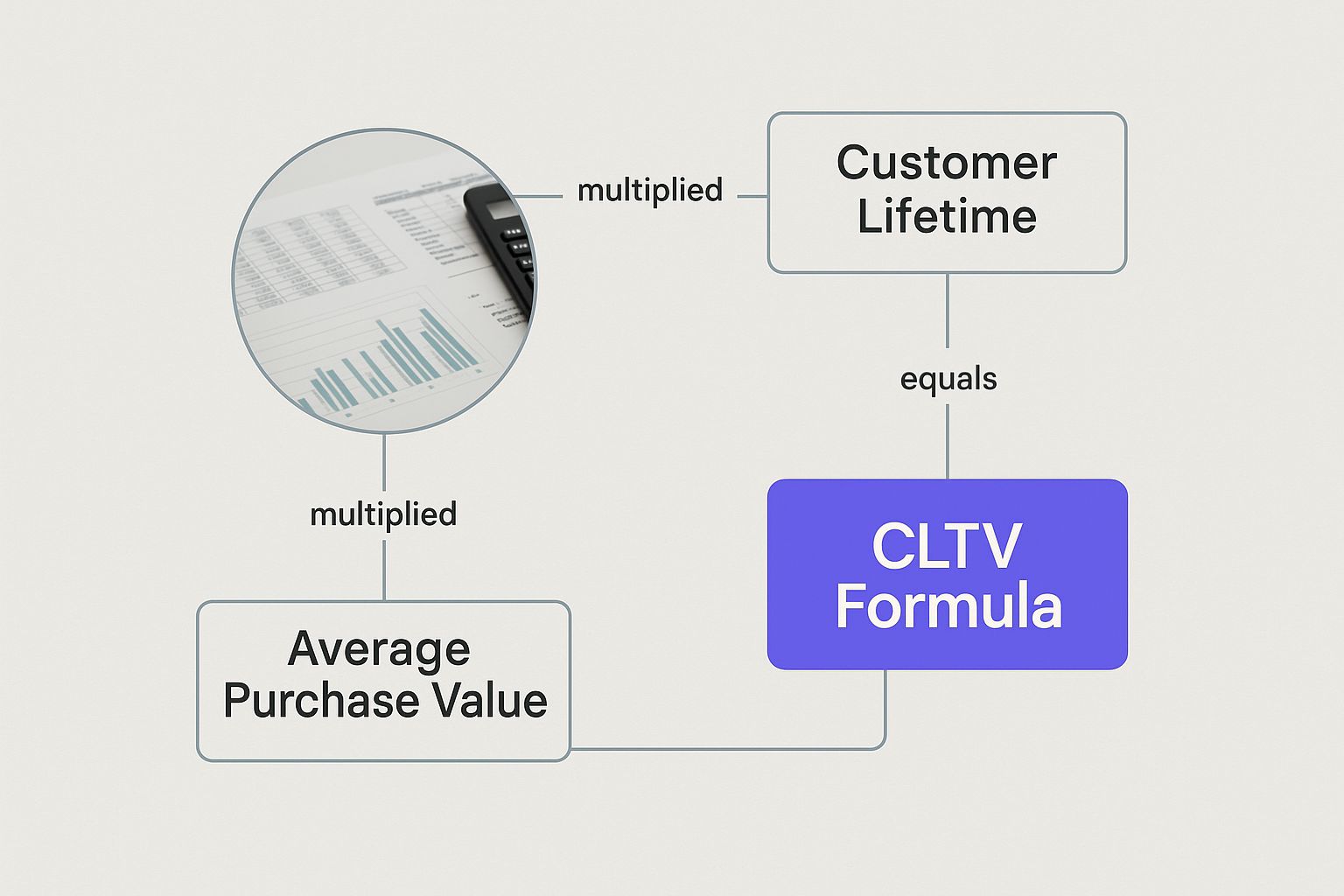

At its heart, the CLTV calculation simply multiplies how much a customer spends per purchase, how often they come back to buy, and for how long they stick around. This simple multiplication gives you a clear, actionable picture of the total revenue you can expect from your average customer relationship.

This infographic does a great job of showing how these different financial data points flow together to create the full CLTV picture.

As you can see, CLTV isn't just some abstract number. It’s the direct result of several connected business metrics, each one telling a crucial part of your customer's journey with your brand.

To really get a handle on CLTV, you need to understand its three main ingredients. Each one is a simple calculation on its own, but when you combine them, they form a powerful predictive metric that can guide your strategy.

To make this easier to digest, here's a quick breakdown of what each piece of the puzzle means.

Think of it like running a popular local coffee shop. Your APV is the price of their usual latte and pastry. Your PF is how many times they stop by in a month. And the CL is how many years they remain a loyal regular. Multiplying these three figures reveals the total value of that customer over time.

The Simple CLTV Formula:Average Purchase Value (APV) x Purchase Frequency (PF) x Customer Lifespan (CL) = Customer Lifetime Value (CLTV)

This basic formula is a fantastic starting point for grasping customer value. For a deeper dive into different calculation methods and some practical tips, check out this comprehensive guide on how to calculate customer lifetime value.

Let's ground this in a real-world example. Imagine you run an online store that sells premium, ethically sourced coffee beans. After digging into your sales data from the past year, you've uncovered the following:

Calculate Average Purchase Value: Your total revenue for the year was $100,000 from 2,000 separate orders.

$100,000 / 2,000 orders = $50 APVCalculate Purchase Frequency: Those 2,000 orders came from 500 unique customers.

2,000 orders / 500 customers = 4 Purchases Per Year (PF)Determine Customer Lifespan: By looking at your historical data, you've noticed that customers typically stick with your brand for about 3 years before moving on.

Customer Lifespan (CL) = 3 yearsNow, let's plug these numbers directly into our simple CLTV formula to see what an average customer is actually worth to your coffee business.

$50 (APV) x 4 (PF) x 3 (CL) = $600

Boom. This calculation shows that, on average, each new customer you bring in is projected to generate $600 in revenue over their entire time with you. This single number is incredibly powerful. It helps you make smarter, data-backed decisions on everything from your marketing budget and retention efforts to your long-term business strategy.

Now that we've covered the components of CLTV, it’s time to get our hands dirty and actually calculate it. The truth is, there's no single "right" way to do this. The best method really depends on your business model and, just as importantly, the data you can actually get your hands on.

We're going to walk through three practical models for finding your CLTV. Each one gives you a different angle, from a simple look at the past to a more sophisticated forecast of the future. By the end, you'll have a much better feel for which approach is the right fit for you.

The most direct way to calculate CLTV is with the Historical Model. There's no complex forecasting here—you're simply adding up the total gross profit from a customer's past purchases. It's clean, simple, and grounded in concrete numbers you already have in your system.

The formula is just the sum of all profits from a specific customer's transactions. While it’s incredibly easy to calculate, its biggest limitation is that it only shows you what has happened, not what’s likely to happen next.

Example: Let's say a customer, Sarah, has been shopping at your online boutique for three years. You pull up her purchase history and see that her total spending has brought in $850 in profit. Her historical CLTV is exactly $850. It's a simple, factual snapshot of her value to your business so far.

The Simplified Traditional Model, which we touched on earlier, is a fantastic middle-ground approach. It uses your average customer behaviors to create a representative CLTV for your entire customer base. This is the model where you multiply Average Purchase Value, Purchase Frequency, and Customer Lifespan.

This calculation leans on key performance indicators (KPIs) like Average Order Value (AOV) and purchase frequency to figure out how profitable your customers are. For instance, if your company made $1,000,000 in annual revenue from 40,000 orders, your AOV is $25. If those orders came from 15,000 unique customers, your purchase frequency is 2.67. You can discover more insights about these core CLTV metrics and their role in your business.

This model gives you a powerful snapshot of customer value without getting bogged down in complexity, making it ideal for businesses that need a quick but meaningful benchmark.

The Traditional Model gives you a single, powerful number that represents the "average" customer. This is incredibly useful for setting marketing budgets and making high-level strategic decisions about customer acquisition costs.

Example: Think about a subscription box service.

Now, let's do the math: ($40 AOV) x (12 purchases per year) x (2.5 years) = $1,200The CLTV for an average subscriber is a cool $1,200.

For businesses ready to really elevate their analysis, the Predictive Model is the gold standard. This forward-looking approach uses historical transaction data and behavioral patterns—often supercharged with machine learning—to forecast how much a customer is likely to spend in the future.

It's definitely more complex, but it's also far more powerful. Predictive CLTV can spot your future high-value customers early on, even before they've spent much money. It's also great for flagging customers who are at risk of churning.

Here’s what makes this model a game-changer:

Example: An e-commerce brand uses a predictive model that looks at a customer's first few purchases, their browsing habits, and how they engage with marketing emails. The model might determine that Customer A, who has only spent $100 so far, actually has a predictive CLTV of $1,500 because their behavior perfectly matches other top-tier customers. Meanwhile, Customer B, who has spent $300, might have a much lower predictive CLTV of $450 because they're showing signs of declining engagement. This is the kind of insight that lets a brand act strategically, one customer at a time.

Alright, let's get into the good stuff. Knowing your Customer Lifetime Value (CLTV) is like getting your bearings—it tells you exactly where you stand. But the real goal is to start moving in the right direction. This is where you find sustainable, long-term growth.

Boosting your CLTV isn't about quick marketing hacks. It’s about methodically building a better business by focusing on what your customers actually want and need.

The great news is that you don't have to start from scratch. By zeroing in on a few critical parts of the customer journey, you can directly influence the things that drive CLTV: how often people buy, how much they spend, and how long they stick around. Let’s walk through some of the most effective strategies you can put into action right away.

Think about it: those first few interactions a customer has with your brand can make or break the entire relationship. A clunky, confusing, or just plain boring start can leave a bad taste in their mouth. But a smooth, welcoming experience? That tells them they made the right choice and gets them excited to engage.

A strong onboarding process should:

A seamless onboarding experience is your first, and best, chance to prove your brand's promise. Getting it right cuts down on early-stage churn and lays the groundwork for a long, profitable relationship.

There's a reason loyalty programs are a classic strategy—they flat-out work. When they're done well, they make customers feel truly appreciated and give them a solid reason to come back to you instead of a competitor. The trick is to design a program that feels like a genuine reward, not just another marketing ploy.

Take the subscription box brand, 123BabyBox. They saw a big drop-off after the three-month mark. So, they changed their pricing to reward commitment, offering bigger discounts for longer subscriptions. That simple tweak pushed their average subscription length from five to eight months, adding nearly $150 in CLTV per customer and slashing churn by 18%.

Effective loyalty programs often include:

Once a customer trusts you, you’ve earned the right to suggest ways they can get even more value. This is where strategic upselling and cross-selling come in. The goal is to be helpful, not pushy, by anticipating their needs before they even do.

These recommendations work best when they're backed by data and feel truly relevant. Look at what your best customers buy together. That insight lets you make personalized suggestions that are far more likely to hit the mark, directly increasing the value of each sale and, ultimately, your CLTV.

Calculating Customer Lifetime Value is a huge step forward for any business. But let's be real—a bad calculation can be worse than no calculation at all. It’s like using a broken compass to navigate; you’ll move with confidence, just in completely the wrong direction.

Relying on a flawed CLTV can lead you to pour money into the wrong marketing channels, chase the wrong customers, and build a strategy on a shaky foundation. So, let’s get honest about the common pitfalls that can trip people up. Knowing what they are is the first step to making sure your CLTV is a sharp, reliable tool for growth.

One of the biggest blunders is calculating a single, "average" CLTV for your entire customer base. This is a classic mistake. When you lump everyone together, you get a number that doesn't truly represent anyone.

Think about it: a high-spending enterprise client who’s been with you for years is worlds apart from a one-time buyer who found you through a holiday sale. Their behaviors, needs, and value are completely different. An average of the two is meaningless.

The fix is simple but powerful: segment your customers before you calculate CLTV. Create different buckets for different types of customers. You can group them by:

Doing this reveals where the real value is. You might discover that a small group of loyalists is driving most of your profit, allowing you to focus your retention efforts where they’ll have the biggest impact.

It's easy to get mesmerized by big revenue numbers. But revenue isn't profit. This is another critical error that can seriously skew your understanding of customer value.

A customer who spends $1,000 might look great on the surface. But what if it cost you $950 in ad spend, shipping, and support to get that sale? Their actual value to your business is only $50. Meanwhile, another customer who only spends $300, but cost just $50 to acquire and serve, is far more profitable.

Remember, you can't take revenue to the bank—only profit. A true CLTV is always based on gross margin, not top-line sales.

Always subtract the costs associated with acquiring and serving the customer from the revenue they generate. This gives you a clear-eyed view of who is actually contributing to your bottom line, preventing you from overspending to attract unprofitable customers.

This one comes down to a simple, timeless rule: "garbage in, garbage out." Your CLTV formula is only as good as the data you feed it.

If your data is a mess—with incomplete purchase histories, missing customer touchpoints, or outdated information—your final CLTV number will be untrustworthy. You can't make smart decisions based on fuzzy math.

To get it right, you need to ensure your data is clean, comprehensive, and current. This usually means pulling together information from all your systems: your CRM, your e-commerce platform, your marketing automation tool, and even your customer support software.

Creating this unified customer view is essential. It’s the only way to build a CLTV you can genuinely trust to steer your business toward sustainable, long-term growth.

Once you start wrapping your head around CLTV, a few practical questions always pop up. Let's tackle some of the most common ones so you can move from theory to practice with confidence.

That's a great question, and while they're deeply connected, they aren't the same thing. It helps to think of loyalty as the cause and CLTV as the effect.

Customer loyalty is all about the relationship—the emotional connection that keeps a customer coming back. CLTV is the metric that puts a dollar value on that relationship, measuring the total profit you gain over the entire time they do business with you. Simply put, a loyal customer almost always delivers a high CLTV.

The right rhythm for calculating CLTV really depends on the pace of your business. If you're in a fast-moving space like e-commerce or SaaS, running the numbers quarterly is a smart move. It’s frequent enough to see how new marketing campaigns or product updates are affecting long-term value.

For businesses with longer, more considered sales cycles, checking in semi-annually or even annually might be all you need. The key is to do it often enough to make timely decisions, but not so often that you're drowning in data.

As a rule of thumb, always recalculate your CLTV after any major strategic change—like a pricing overhaul, a big marketing push, or a new product launch. It’s the clearest way to measure the real impact of your decisions.

This is the million-dollar question, but the answer isn't a specific number. A "good" CLTV is all about its relationship to your Customer Acquisition Cost (CAC). For a business to be healthy, your CLTV needs to be substantially higher than what you spend to get that customer in the door.

The magic number everyone talks about is a CLTV to CAC ratio of 3:1.

Instead of chasing a specific dollar amount, focus on improving that critical ratio. That’s where real, sustainable growth comes from.

Ready to stop guessing and start predicting customer value? Statisfy uses AI to turn your raw customer data into actionable insights, helping you identify high-value customers and automate retention strategies. See how our platform can boost your CLTV by visiting https://www.statisfy.com.